Vital Tips for Comparing Insurance Offers Efficiently

Exploring Various Sorts Of Insurance Coverage: A Comprehensive Overview

Medical Insurance

In today's increasingly intricate health care landscape, wellness insurance policy works as a crucial secure for families and individuals, guaranteeing access to essential medical solutions - insurance. It provides financial security against high medical expenses, enabling insurance policy holders to get timely and adequate care without sustaining debilitating expenses

Medical insurance prepares typically come under numerous categories, including employer-sponsored strategies, federal government programs like Medicare and Medicaid, and individual plans acquired via marketplaces. Each type provides different insurance coverage degrees, premiums, and out-of-pocket expenses. Secret parts of many health insurance policies include copayments, deductibles, and coinsurance, which determine how costs are shared in between the insurance firm and the insured.

Selecting the ideal wellness insurance policy plan requires mindful factor to consider of private wellness demands, budget plan restraints, and provider networks. insurance. It is important to examine advantages like precautionary care, hospitalization, prescription medications, and expert solutions. Additionally, recognizing the strategy's terms and problems can assist stay clear of unanticipated costs.

Car Insurance

While navigating the roadways can bring unexpected difficulties, auto insurance is essential for protecting chauffeurs and their automobiles from monetary losses resulting from mishaps, burglary, or damages. It works as an essential financial safeguard, making sure that the expenses connected with fixings, clinical costs, and liability claims are covered.

Vehicle insurance policy normally consists of several kinds of protection. Liability insurance coverage is compulsory in a lot of states, securing versus claims made by others for bodily injury or building damage. Collision insurance coverage pays for damages to your automobile resulting from a crash with one more car or things, while thorough protection addresses non-collision-related incidents such as theft, vandalism, or all-natural catastrophes.

Drivers can additionally take into consideration additional alternatives such as uninsured/underinsured driver protection, which safeguards versus motorists doing not have adequate insurance policy. Costs are influenced by different elements, consisting of driving history, automobile type, and area.

Life Insurance Policy

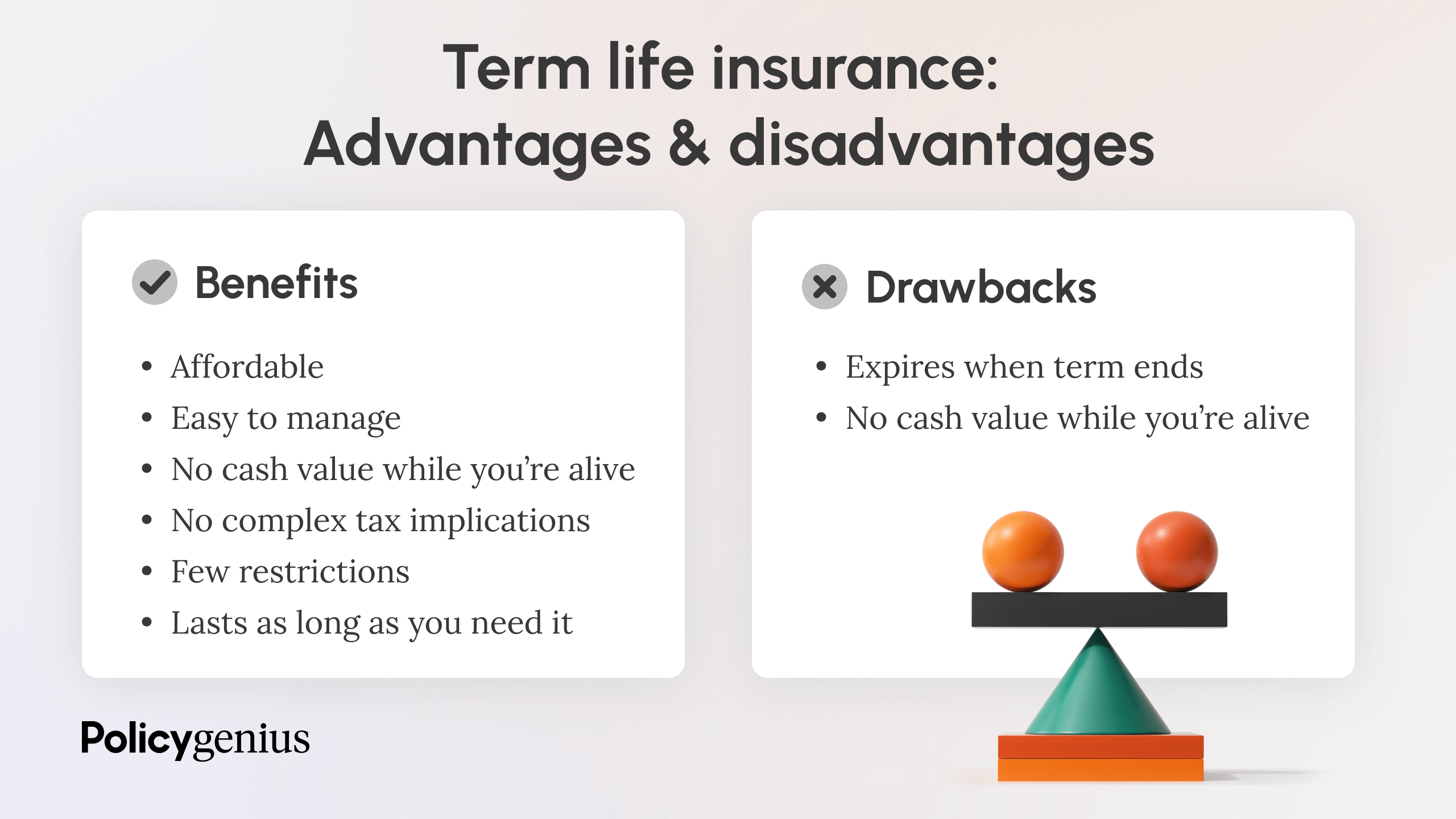

Auto insurance policy secures drivers on the roadway, however life insurance offers a different type of safety by protecting the monetary future of over here loved ones in the event of the insurance policy holder's death. Life insurance coverage plans usually fall into 2 primary categories: term life insurance and entire life insurance coverage.

Term life insurance supplies coverage for a defined term, normally ranging from 10 to 30 years. If the insured dies during this period, recipients get a death advantage. This kind of policy is often extra budget friendly, making it an appealing choice for those looking for short-lived coverage.

On the various other hand, whole life insurance policy uses long-lasting defense and consists of a money worth component that builds up gradually - insurance. This money worth can be borrowed against or withdrawn, supplying insurance holders with additional financial adaptability. Whole life insurance policy costs are normally more than those of term plans, reflecting the lifelong insurance coverage and important site savings aspect

Inevitably, choosing the ideal life insurance depends upon private conditions, economic objectives, and the specific requirements of beneficiaries. By recognizing the differences between these policies, individuals can make enlightened choices to ensure their loved ones are financially safe.

Building Insurance Policy

Property insurance is essential for protecting your tangible assets, such as homes, industrial buildings, and personal belongings. This sort of insurance policy supplies monetary insurance coverage against threats such as fire, burglary, vandalism, and natural disasters, making certain that insurance policy holders can recoup their losses and rebuild after damaging occasions.

There are numerous sorts of residential or commercial property insurance coverage offered, including house owners insurance policy, occupants insurance policy, and business building insurance. Home owners insurance coverage generally covers the framework of the home and individual valuables, while likewise giving obligation protection. Occupants insurance coverage safeguards tenants' personal possessions and offers liability insurance coverage, though it does not cover the physical structure itself. Business residential property insurance coverage is developed for companies, protecting their structures, devices, and inventory from numerous risks.

When picking residential or commercial property insurance coverage, it is vital to examine the value of your properties and the specific threats linked with your place. In general, residential property insurance policy plays an essential duty in monetary security and peace of mind for individuals and organizations alike.

Specialty Insurance

Specialized insurance policy provides to special dangers and needs that are not generally covered by typical insurance plan. This sort of insurance coverage is developed for individuals and organizations that need coverage for details, usually uncommon scenarios. Examples include insurance policy for high-value antiques, such as art and vintages, along with policies for niche industries such as cyber, air travel, and marine responsibility.

Among the crucial advantages of specialized insurance coverage is its ability to discover this info here give personalized solutions customized to the insured's particular demands. For example, occasion organizers might seek specialized coverage to secure versus prospective responsibilities connected with large events, while businesses in the innovation field could search for cyber responsibility insurance policy to secure versus data violations.

Furthermore, specialized insurance policy frequently consists of coverage for arising dangers, such as those pertaining to climate modification or advancing modern technologies. As the landscape of threat continues to change, companies and individuals are progressively acknowledging the relevance of safeguarding specialized protection to alleviate possible monetary losses. Investing and comprehending in specialized insurance policy can be a tactical choice that not just protects unique assets but additionally boosts general danger administration approaches.

Conclusion

From health and vehicle insurance policy to life and residential or commercial property coverage, each category provides unique advantages customized to details needs.Auto insurance typically consists of several types of protection. Entire life insurance premiums are normally greater than those of term plans, showing the lifelong coverage and financial savings aspect.

There are several kinds of home insurance offered, including house owners insurance coverage, renters insurance coverage, and commercial residential property insurance.Specialized insurance policy caters to one-of-a-kind risks and needs that are not commonly covered by basic insurance plans.